Section 1: The U.S. Tariff Strategy – Economics Behind the Aggression

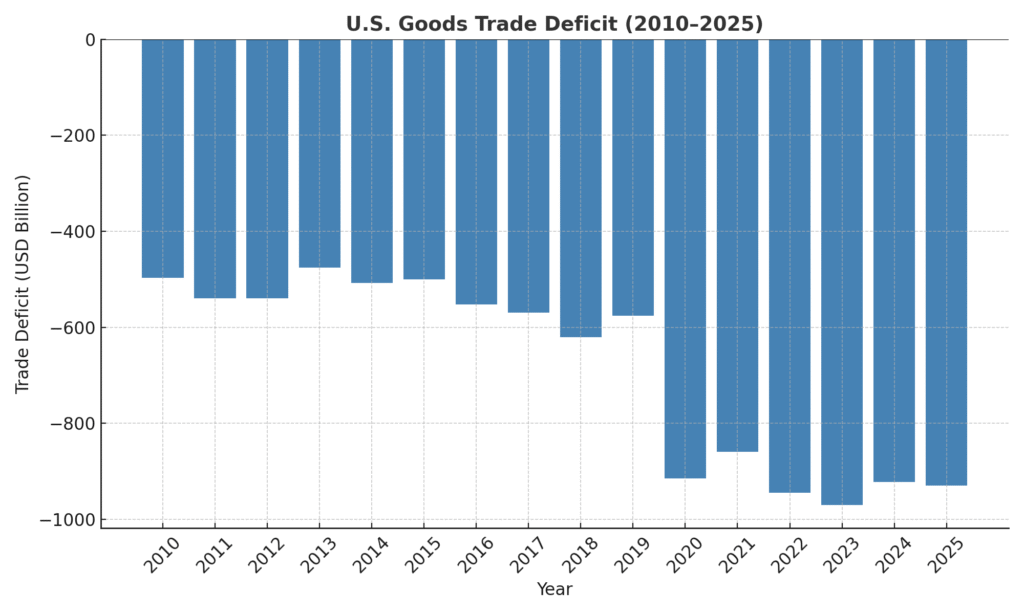

The United States enters this latest trade confrontation with India against a backdrop of severe fiscal stress and structural trade imbalances. As of mid-2025, the U.S. national debt stands at over $37 trillion, with annual interest servicing costs projected to surpass $1.3 trillion – more than the federal government’s entire defense budget. This debt burden is compounded by a persistent goods trade deficit, which has averaged over $900 billion annually in recent years.

Trump’s renewed tariff push must be understood within this context. By imposing tariffs on imports, his administration seeks to achieve three interconnected goals:

- Generate Revenue – Tariffs serve as a direct source of federal income without raising domestic taxes.

- Reduce Imports – Making imported goods more expensive incentivizes substitution toward domestic alternatives.

- Re-shore Manufacturing – The ultimate objective is to encourage multinational companies to set up production facilities within U.S. borders.

The underlying logic is straightforward: If you manufacture abroad and want to sell in the U.S., you must pay a tariff. If you manufacture in the U.S., you gain a price advantage and avoid tariff costs.

How This Strategy is Supposed to Work

The intended chain reaction is:

- Tariff on imports → Higher landed cost in U.S. → Consumers/businesses seek cheaper domestic options → Firms shift manufacturing to the U.S. → U.S. industrial base expands → Trade deficit narrows → Economic growth and tax revenues rise → Debt burden becomes more manageable.

However, this is an ambitious long-term vision, and the short-term realities are far more complex. Manufacturing ecosystems cannot be recreated overnight, especially in sectors where the U.S. has lost ground for decades.

Table 1: U.S. National Debt and Interest Costs (Selected Years)

| Year | National Debt (USD Trillion) | Annual Interest Payments (USD Billion) | Debt-to-GDP Ratio (%) |

|---|---|---|---|

| 2015 | 18.2 | 402 | 104 |

| 2020 | 26.9 | 523 | 129 |

| 2025* | 37.1 | 1,310 | 138 |

*2025 figures are estimates based on Congressional Budget Office projections.

Chart 1: U.S. Goods Trade Deficit (2010–2025)

Section 2: Sectoral Challenges, The Labor-Intensive Dilemma

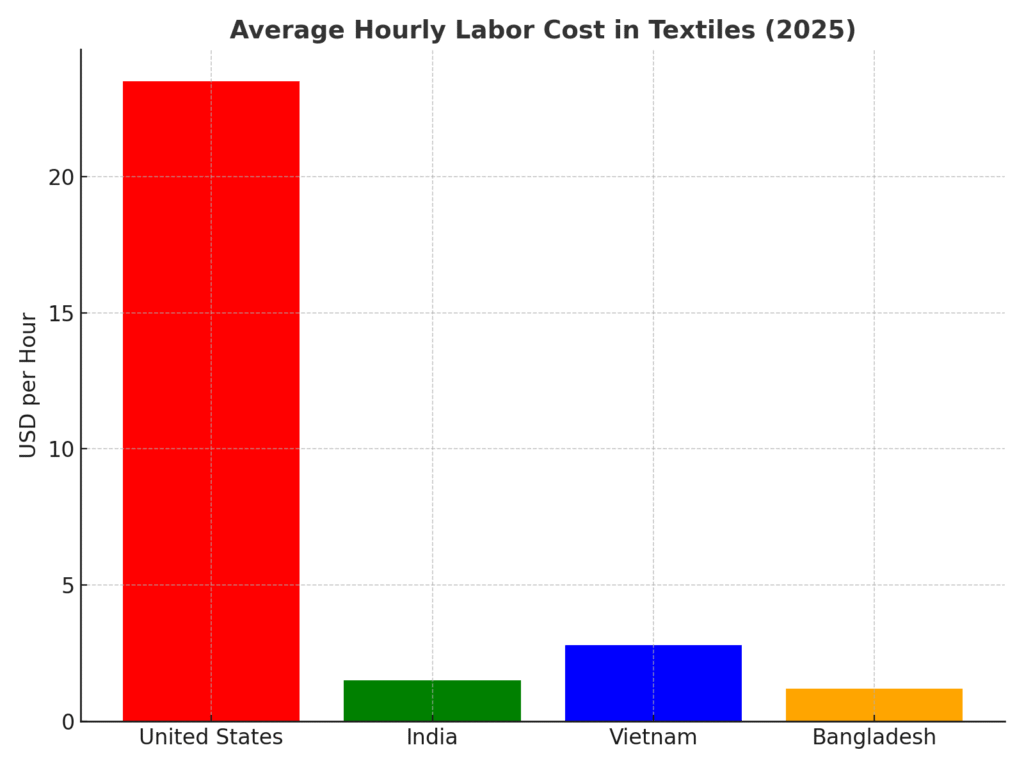

While Trump’s tariff strategy may be designed to protect U.S. jobs and revive domestic manufacturing, certain industries face structural hurdles that cannot be solved by tariffs alone. Nowhere is this more evident than in labor-intensive sectors such as textiles, footwear, furniture, and certain consumer electronics assembly.

The U.S. lost much of its global competitiveness in these sectors decades ago. Factories relocated to countries with far lower labor costs, more flexible regulatory environments, and established supply chains. For example, the textile and apparel supply chains in countries like Bangladesh, Vietnam, and India are deeply integrated – from cotton farming to spinning mills to garment stitching – with decades of infrastructure, skilled labor pools, and export experience.

In contrast, rebuilding these capacities in the U.S. would require:

- Significant capital investment in manufacturing plants.

- Re-establishing entire supply chains domestically, including raw material sourcing.

- Training or retraining a labor force for mass-scale production.

- Automating to offset high wages, which is viable in some sub-sectors but challenging in others where craftsmanship or flexible labor is critical.

Even with a 20% or 30% tariff, the price advantage of imports may persist. Let’s consider a simple scenario:

Example: Cotton Shirt Production Costs (per piece)

| Cost Component | Bangladesh (USD) | United States (USD) |

|---|---|---|

| Labor | 0.30 | 3.00 |

| Materials | 2.00 | 2.50 |

| Overheads & Energy | 0.50 | 1.20 |

| Total Cost | 2.80 | 6.70 |

A 25% tariff on the Bangladeshi shirt raises its U.S. landed cost to $3.50 – still almost half the domestic production cost.

Chart 2: Average Hourly Labor Cost in Textiles (2025)

This is why U.S. companies often prefer importing – even with tariffs – unless domestic production is strategically subsidized or heavily automated. In footwear, the equation is similar, and consumer willingness to pay higher prices remains a major unknown.

Section 3: The India – U.S. Trade Negotiation Deadlock

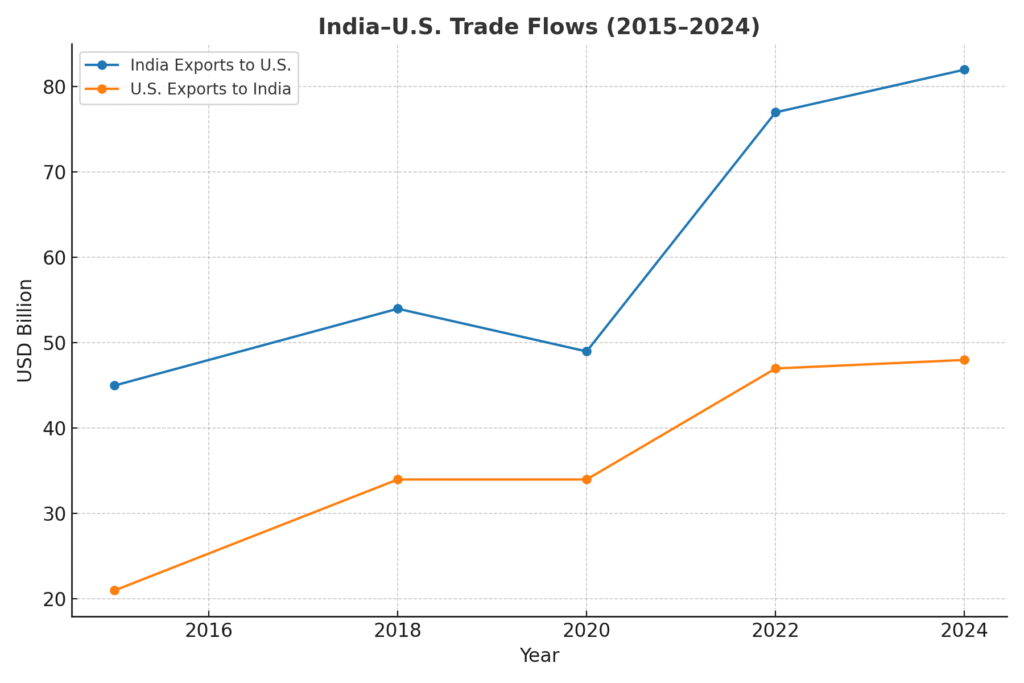

India and the U.S. are natural trade partners, with complementary strengths – the U.S. being a market for technology, services, and goods, and India being a competitive exporter of pharmaceuticals, textiles, gems, machinery, and IT services.

Bilateral trade has grown steadily:

Chart 3: India – U.S. Trade Flows (2015–2024)

However, trade talks repeatedly run aground over market access issues. In the current round, the U.S. is pressing India to open its agriculture and dairy markets. This is not a new demand as it dates back to earlier administrations – but the political context in India makes it particularly sensitive.

Why Agriculture & Dairy Are “Red Lines” for India:

- Livelihoods – Agriculture still supports over 40% of India’s workforce. Sudden liberalization could lead to large-scale job losses in rural areas.

- Price Stability – Indian farmers depend on Minimum Support Prices (MSPs) and protective tariffs to shield them from volatile global commodity markets.

- Cultural & Dietary Factors – Dairy is not just an industry in India, it’s deeply tied to dietary habits, religious sentiments, and rural economies.

- Political Sensitivity – With elections always on the horizon, no government wants to be seen as compromising farmer livelihoods to strike a trade deal.

On the flip side, the U.S. dairy industry, especially in Wisconsin and California, has surplus production capacity and views India’s 1.4 billion consumers as a lucrative market. This creates a fundamental clash of interests.

As a result, while India is open to negotiating tariff reductions in sectors like industrial goods, electronics, and clean energy, it remains steadfast on agriculture and dairy – making it the single largest stumbling block in these talks.

Section 4: The Russia Factor – Oil, Energy, and Double Standards Debate

The Russia–Ukraine war has forced countries worldwide to rethink energy sourcing. India, leveraging its strategic autonomy, has increased its imports of discounted Russian oil. From New Delhi’s perspective, this is purely an economic decision – sourcing cheaper crude benefits Indian consumers and industries.

In early August 2025, the Trump administration announced:

- A 25% tariff on Indian goods in retaliation for continued Russian oil purchases.

- Days later, this was escalated by an additional 25% tariff, taking some goods to an effective 50% duty.

Critics in India and globally argue this reflects selective enforcement.

- Europe continues to import Russian LNG and fertilizers.

- Turkey has expanded energy imports from Russia.

- China remains a major buyer of Russian oil and gas.

Yet, none of these countries face equivalent U.S. tariffs – suggesting the move is less about sanctions consistency and more about pressure tactics to extract concessions in trade talks.

Prime Minister Modi’s response was pointed. He reiterated:

- India will not compromise on agriculture, dairy, or fishermen’s livelihoods.

- Sovereign decisions on energy sourcing will be made in India’s national interest.

- He rejected Trump’s repeated claims of “mediating” between India and Pakistan to avert war – a claim India has publicly debunked multiple times.

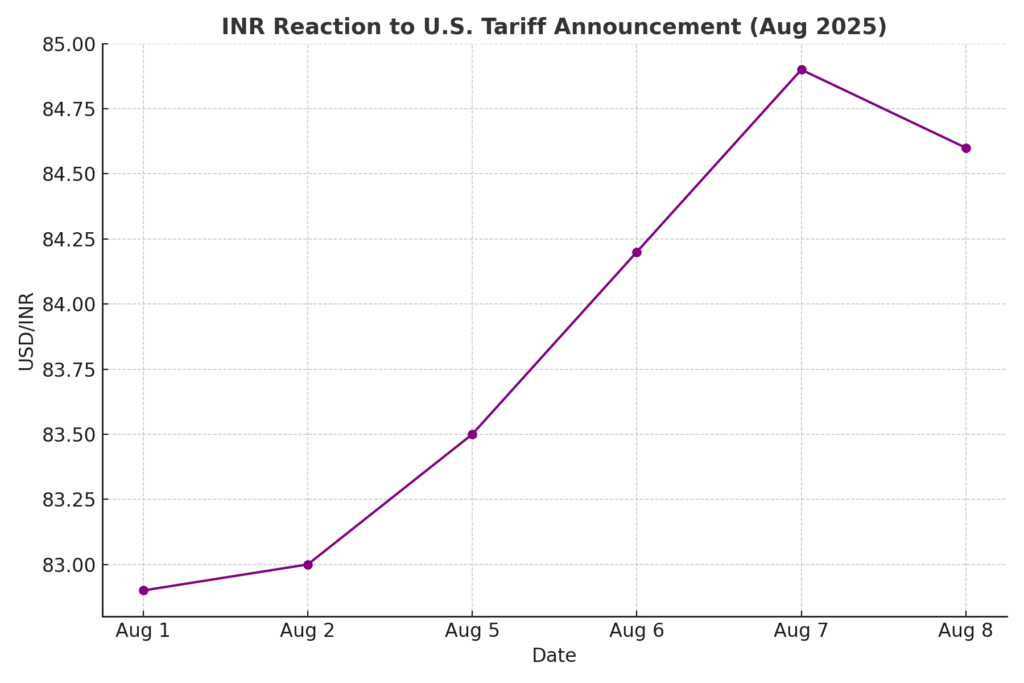

Market reaction was swift:

- The Indian rupee weakened sharply from 82.9 to 84.9 per USD in days.

- Gold prices spiked as investors sought safe-haven assets.

- Exporters scrambled to assess cost impacts.

Chart 4: INR Reaction to U.S. Tariff Announcement (Aug 2025)

Section 5: Strategic Partners in Turbulent Times

It is important to view this standoff in the broader strategic context. The U.S. – India relationship is multidimensional, encompassing:

- Defense Cooperation – Joint exercises like Malabar, U.S. defense sales to India.

- Technology Partnerships – Semiconductor manufacturing, space collaboration.

- Indo-Pacific Strategy – Counterbalancing China’s assertiveness.

- Climate & Energy – Clean energy investments, solar and hydrogen initiatives.

The tariff dispute, while significant, is unlikely to permanently derail the partnership because the strategic stakes are too high for both sides.

Why Resolution Is Likely in 2025:

- Quad Summit – Trump’s planned September visit to India is a natural diplomatic window for an announcement.

- Geopolitical Signaling – A trade deal would send a message of allied unity in the Indo-Pacific.

- Economic Logic – Both sides benefit from reducing barriers: U.S. firms gain Indian market access, Indian exporters retain U.S. competitiveness.

Section 6: Investing Through Uncertainty -Lessons from History

While trade disputes and geopolitical tensions can trigger market volatility, history shows that markets recover from crises – often faster than expected.

Consider three major shocks:

- 9/11 Attacks (2001) – Global markets fell sharply but recovered within months.

- Lehman Brothers Collapse (2008) – Markets plunged over 50%, but the subsequent bull market lasted a decade.

- COVID-19 Pandemic (2020) – Global markets fell over 30% in weeks, yet rebounded to record highs within months.

Key Takeaways for Investors:

- Volatility is Temporary -Shocks often appear monumental in the moment but fade over the long term.

- Time in the Market Beats Timing the Market – Missing just the best 10 days in a decade can slash returns dramatically.

- Diversification Works – Spreading across asset classes cushions portfolio shocks.

- Stay the Course – Systematic investing through downturns captures recovery gains.

In the context of the current U.S. – India tariff tensions:

- Short-term volatility in the Indian rupee, equities, or certain export-focused stocks may create buying opportunities.

- Defensive or domestic focused sectors like FMCG, Renewables, Infrastructure, BFSI, etc. may see resilience.

- Exporters to non-U.S. markets could be relative beneficiaries.

Long-term investors should focus on fundamentals, not headlines. Trade disputes, wars, and pandemics are part of the market’s history – but the dominant trend, over decades, is upward.

Conclusion

The Trump–India tariff standoff is a reminder that economics and geopolitics are inseparable in the modern world. For policymakers, the challenge is balancing national interest with strategic partnerships. For investors, the lesson is patience: while turbulence is inevitable, history rewards those who stay invested.