Section 1: Introduction – The Age of Energy Transition

The world is undergoing a once-in-a-century transformation in how energy is generated, stored, and consumed. As governments, corporations, and investors pivot toward decarbonization, the shift from fossil fuels to renewable energy sources is gaining momentum. For India, the energy transition is not only a climate imperative but also a massive economic opportunity. This article explores the key verticals in this transformation—solar, green hydrogen, BESS (Battery Energy Storage Systems), transmission infrastructure, and nuclear energy—and identifies Indian companies positioned to benefit from this multi-decade trend.

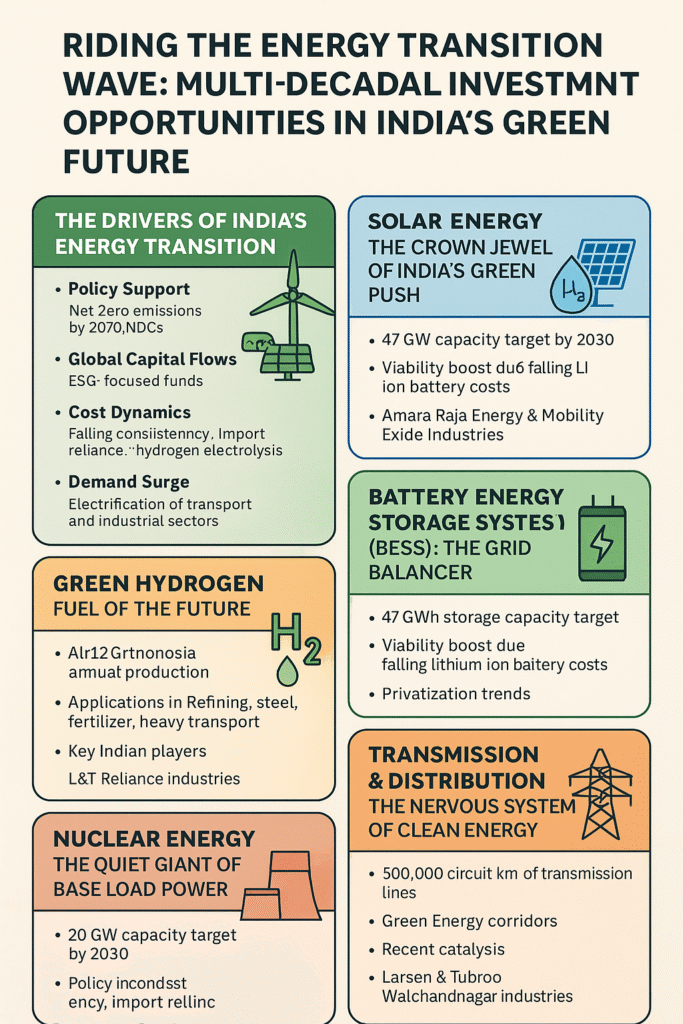

Section 2: The Drivers of India’s Energy Transition

India’s energy transition is not a simple shift—it’s a structural realignment of the economy, infrastructure, and society. Several powerful forces are converging to make this transformation both urgent and inevitable. This section explores the six critical drivers propelling India’s energy shift and explains why this isn’t just a passing trend, but a multi-decade investment opportunity.

1. Policy and Regulatory Push: A National Commitment to Green Growth

India has made bold international commitments and policy declarations that are now cascading down into actionable missions and subsidies. At the COP26 summit, India pledged to achieve net-zero emissions by 2070, with interim targets including:

- 500 GW of non-fossil fuel capacity by 2030.

- 50% of electricity from renewable sources by 2030.

- Reduction of emissions intensity of GDP by 45% from 2005 levels.

The National Green Hydrogen Mission, PLI schemes for solar PV modules, FAME-II for electric vehicles, and carbon market frameworks are turning intent into structured execution. Government-owned entities like NTPC, Indian Railways, and IndianOil are under active mandates to decarbonize their operations, providing anchor demand for new technologies.

States are also stepping up with solar park policies, open-access reforms, and transmission corridor approvals, creating a unified national front in the green energy push.

2. Global Capital Realignment: Green Is the New Gold

Global capital is increasingly flowing toward companies and countries aligned with climate goals. Asset managers controlling trillions of dollars—like BlackRock and Vanguard—have signed up to ESG mandates that prioritize green investments. Sovereign wealth funds, climate-tech VCs, and development banks are making India a favored destination for green capital due to:

- Low cost of renewable energy.

- Huge market potential.

- Government stability and improving ease of doing business.

Recent examples include:

- Brookfield and Temasek’s billion-dollar bets on renewables and green infra in India.

- Saudi Arabia’s ACWA Power and Japan’s SoftBank earlier pouring capital into Indian solar ventures.

- Indian corporate green bonds and green IPOs gaining traction.

This international validation and funding lowers the cost of capital, enabling Indian players to scale up fast.

3. Falling Costs: The Economics Now Work Without Subsidies

For years, renewable energy needed incentives to compete. That era is ending. In India:

- Levelized cost of solar energy is now ₹2.3–2.8/kWh, cheaper than coal in many cases.

- Battery costs have declined over 85% in the last decade, making BESS commercially viable.

- Green hydrogen production costs, currently around $3–5/kg, are projected to fall below $1/kg by 2030, making it competitive with grey hydrogen.

In short, clean energy is no longer a charity—it’s good business. This cost parity is unlocking natural market demand, even without regulatory pushes.

4. Technology and Innovation: Disruption Beyond the Power Plant

Innovation across the value chain is making the transition smarter and faster:

- AI and IoT in energy management enable predictive grid balancing.

- Digital twins and SCADA systems allow real-time optimization of generation and storage.

- Electrolyzer and battery tech advancements are reducing production and lifecycle costs.

- Blockchain-based power trading is being piloted to ensure transparent peer-to-peer transactions.

Indian startups and legacy players alike are investing in R&D. Public-private partnerships and academic-industry collaboration (like IITs working with PSU energy companies) are accelerating innovation adoption.

5. Demand Surge: Electrification of Everything

India’s electricity demand is projected to double by 2040, driven by:

- Urbanization: Over 400 million people expected to move to cities by 2050.

- Digitalization: Data centers, cloud services, and mobile infrastructure need 24/7 power.

- Mobility shift: Electric vehicles, metros, and e-rickshaws expanding rapidly.

- Industrial decarbonization: Steel, cement, and refining sectors moving toward green fuel.

This demand cannot be sustainably met by coal. Clean energy must step in—and fast. The scale of electricity needed over the next 15 years guarantees a long runway for investment in generation, transmission, and storage.

6. Strategic and Geopolitical Imperatives: Energy Independence and Security

India imports over 85% of its crude oil and about 55% of its gas. These imports cost the country over $150 billion annually, making it vulnerable to geopolitical shocks, like the Russia-Ukraine conflict or OPEC+ supply cuts.

Energy transition is not just about climate—it’s about national security. By investing in:

- Solar and wind with localized supply chains.

- Green hydrogen for strategic sectors.

- Battery storage to reduce peak hour dependence on fossil fuel backup.

- Smart grids that reduce technical and commercial losses.

India is reducing its energy import bill and improving grid resilience. Clean energy also insulates the economy from global fossil fuel volatility, making macroeconomic management smoother.

Section 3: Solar Energy – The Crown Jewel of India’s Green Push

- Capacity Targets: India aims for 280 GW of solar capacity by 2030.

- PLIs and Manufacturing Incentives: Boost to domestic module and cell manufacturing.

- Investment Opportunities:

- Adani Green Energy: Largest developer of solar parks.

- Tata Power Solar: Integrated player with EPC and utility-scale operations.

- Waaree Energies (IPO-bound): Module manufacturing leader.

- Boroscil Renewables: Solar glass supplier.

- Websol Energy, Surana Solar: Smaller but upcoming manufacturers.

- Risks: Policy inconsistency, import reliance, and DISCOM payment delays.

Section 4: Green Hydrogen – Fuel of the Future

- National Green Hydrogen Mission: ₹19,744 crore allocated with target of 5 MMT annual production by 2030.

- Applications: Refining, steel, fertilizer, and heavy transport sectors.

- Electrolyzer Manufacturing: A hotbed of innovation and JV activity.

- Key Indian Players:

- L&T: Setting up electrolyzer manufacturing with ReNew and IndianOil.

- Reliance Industries: Multi-pronged investment in hydrogen value chain.

- NTPC: Piloting green hydrogen projects for mobility and blending.

- Adani New Industries Ltd (ANIL): Building integrated green hydrogen ecosystem.

Section 5: Battery Energy Storage Systems (BESS) – The Grid Balancer

- Why BESS Matters: Renewables are intermittent; BESS ensures grid reliability.

- Viability Boost: Falling lithium-ion battery costs, duty rationalization, and domestic R&D.

- India’s Ambition: 47 GWh battery storage capacity target by 2030.

- Stocks to Watch:

- Amara Raja Energy & Mobility: Investing in Li-ion cell Giga factories.

- Exide Industries: Partnering with SVOLT for lithium battery production.

- HBL Power Systems: Niche player in defense-grade batteries.

- Panasonic Energy India, Eveready (long shot plays): Potential pivots.

Section 6: Transmission & Distribution – The Nervous System of Clean Energy

- The Challenge: India must add 500,000 circuit kilometers of transmission lines to integrate RE capacity.

- Green Energy Corridors: Government-supported buildout to evacuate RE efficiently.

- Privatization Trends: Asset monetization opening up investment avenues.

- Stocks Benefiting:

- Power Grid Corporation: Backbone of India’s transmission network.

- Kalpataru Projects International (formerly KEC): EPC player with global presence.

- Sterlite Power: Focus on private transmission assets and InvITs.

- Techno Electric & Engineering: Niche EPC and O&M play.

Section 7: Nuclear Energy – The Quiet Giant of Base Load Power

- Why It Matters: Unlike solar/wind, nuclear provides 24/7 base load with zero emissions.

- India’s Strategy: 20 GW capacity target by 2030, mostly via indigenous PHWRs.

- Recent Catalysts: Government allowing PSUs to partner with private sector for component supply and execution.

- Stocks with Exposure:

- Larsen & Toubro: Heavy engineering components for reactors.

- Walchandnagar Industries: Longtime supplier of critical reactor components.

- Hindustan Construction Company (HCC): Civil works for nuclear plants.

- BHEL: Turbine and equipment supplier for nuclear projects.

Section 8: EPC Giants Riding the Green Capex Boom

- Why EPC Matters: Execution capacity is the real bottleneck in energy projects.

- Beneficiaries:

- L&T: Across solar, hydrogen, transmission, and nuclear.

- KPTL (Kalpataru Projects): Transmission-focused EPC with global footprint.

- Sterling & Wilson Renewable Energy: Pure-play solar EPC.

- NBCC & Engineers India Ltd: Government-aligned engineering arms in green energy and hydrogen infra.

- Evaluation Criteria for EPC Stocks: Order book, margins, execution timeline, geographical spread.

Section 9: Ancillary & Emerging Opportunities

- Transformers:

- Voltamp Transformers, Schneider Electric Infra, Siemens India.

- Smart Grids & Metering:

- Genus Power, HPL Electric, ITI Ltd.

- Electrolyzer Tech & Green Ammonia:

- Thermax (R&D), Praj Industries (ethanol and green fuel).

- Software and Monitoring:

- KPIT Technologies (EV software), Tata Elxsi (mobility, grid AI).

Section 10: Risks & Challenges to Watch

- Regulatory Volatility: Changes in import duties, PPA renegotiations.

- Capital-Intensive Nature: Large upfront investments, long payback periods.

- Supply Chain Constraints: Rare earth dependency, battery metals, global chip supply.

- Execution Risks: Land acquisition, labor delays, grid integration.

- Valuation Bubbles: Overpriced green stocks without earnings to support.

Section 11: How to Play the Theme – Investor Strategies

- Direct Stock Picking: Focus on integrated players with execution track record.

- Thematic Mutual Funds: ICICI Prudential Green Energy Fund, Nippon India Power & Infra Fund.

- REITs/InvITs: Sterlite Power’s transmission InvIT.

- Green Bonds: Government/PSU green bond issuances with fixed returns.

- SME & IPO Radar: Watch for upcoming players in solar, hydrogen, BESS.

Conclusion – The Power of Patience in Green Investing

India’s energy transition is not a quarterly story—it’s a decade-long megatrend. Like IT and Telecom in the early 2000s, Green Energy is poised to reshape India’s investment landscape, offering immense upside for those with vision and patience. A diversified approach across solar, hydrogen, BESS, and transmission, with a keen eye on execution and valuations, can position investors to ride this wave of sustainable wealth creation.